In my previous article, “Preserving Family Wealth is a Generational Effort,” I mentioned that “Wealth equals capital, which equals potential (Wealth = Capital = Potential).” In other words, a healthier way to view family wealth, is to view it as capital that can be applied in a way that maximizes the well-being, purpose, love, productivity, family unity, and the positive impact the family can have on the community and causes that are near and dear to them. These attributes are capitalized on when a Family Legacy focuses on the three forms of family wealth (or capital), which are financial capital, human capital, and intellectual capital. I mentioned in the previous article, that there is spiritual capital. But arguably, it is a component of human capital.

Another consideration that is critical in developing a family legacy, is the generations that follow. If traditional estate planning methods are applied stand alone, the immediate inheriting generation may make the inheritances last, but is often doubtful. But what is almost certain, is if the future generations inherit this wealth through traditional methods, the risk of the wealth vanishing, dramatically increases, and the family can become fragmented.

So, how do we begin the journey of developing a family legacy? By carefully planning and preparing for a family retreat. A family retreat is a daylong retreat (usually in a remote location) where the first-generation wealth accumulators, along with a legacy coach, express matters near and dear to them. More specifically, discussions of their:

- family values

- philosophy on life

- wishes for the family

- desires for family growth

- ideas on strengthening the family bond

- future impact on the community

- perspectives on strengths and weaknesses within the family

- family opportunities

- family culture

- thoughts on characteristics of each family member

- other relevant familial issues

There are several tools that the legacy coach can utilize to help the Gen 1 members (usually Mom and Dad) develop their thoughts in each of these areas. Before the actual retreat, The Gen 1 members complete a Living Legacy questionnaire, and a “Values and Clarification Worksheet.” Both family member/s are also encouraged to write an Ethical Will (See my earlier article on writing an “Ethical Will”). Additionally, I encourage them to watch a few movies on family wealth and its potential opportunities and pitfalls. These movies can include “The Ultimate Gift” and a documentary titled “Born Rich.” The “Ultimate Gift” is a great story with a positive ending that ties wealth and life purpose together. “Born Rich” is an eye-opening documentary of the challenges and potential damage wealth can inflict on future generations.

Taking these steps will prepare the meeting facilitator to effectively conduct the retreat and will also begin the Gen 1 members down the path of focusing on what’s important and near and dear to the family, structure their wealth to last for many generations, and help the family members to grow and thrive.

The retreat needs to be a safe space – A place where deep discussions can be shared, deep trust and confidentiality can be established, and maximum privacy can be achieved. All information remains confidential. At the beginning of the retreat, the legacy questionnaire is discussed at great length, and the completed Values and Clarification worksheets are discussed and prioritized.

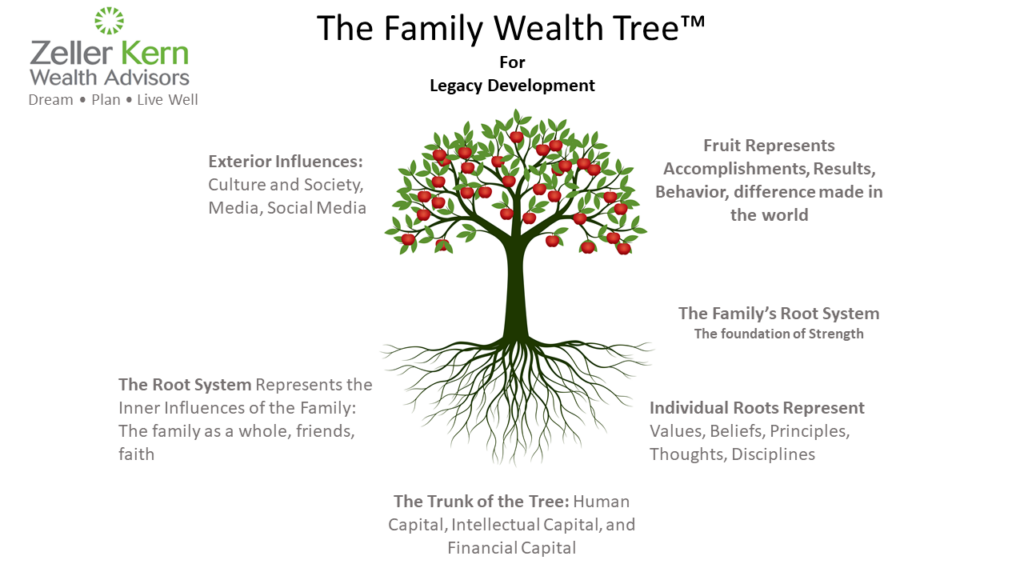

Additionally, another valuable exercise to go through, during the family retreat, is to draw the family wealth tree. It is a symbolic interpretation of the family values, beliefs, principles, actions, results, and outer influences.

Ultimately, the family retreat will produce the following: A trial “Mission Statement,” a trial “Vision Statement,” a trial “Financial Philosophy Statement,” and “Family Letters of Intent.” A rough draft family legacy plan can then be assembled.

After the Family Retreat has been completed and the trial vision statement, mission statement, and family financial philosophy statement has been completed, the next step is to organize a Family Meeting. This involves the Gen 1 accumulators and the rest of the family. I will discuss the concept of the family meeting, in greater detail, in my next article.

Ultimately, the result of this effort is the formation of family governance, to which every family member is involved in meaningful and impacting decisions that are in-line with the vision and mission. Furthermore, a long-lasting legacy is set into place that includes all of the necessary estate planning and structuring, in such a way that it promotes the growth of the family– human, intellectual, and financial capital, and protects the well-being of the family over several generations.

If you have any questions on this subject, or would like more information, feel free to contact me at szeller@zellerkern.com.

Steve Zeller

Steven E. Zeller

Steven Zeller is a CERTIFIED FINANCIAL PLANNER™ professional, Accredited Investment Fiduciary®, Certified Exit Planner, practicing Wealth Advisor, and serves clients nationwide. He has over 24 years of experience within his profession. READ MORE

What Steve Writes About

I write about the latest thoughts and topics that impact high net worth families, individuals, and business owners. The building and sustainability of family wealth and a business is an exciting journey, and I have a passion to help them along the way to grow and thrive.

The latest book that Steve is reading. He reads, all he can, material relevant to the high net worth family and business owners, so that he may pass it onto his readers.

Connect With Steve