One of the more challenging steps for a Business Owner in planning their exit is determining the best option for selling their business, which is often based on their personal situation, goals for the company, employees, and family members.

However, one of the more tax-efficient strategies and options for the sale of the business is the Owner selling to an ESOP or an Employee Stock Ownership Plan. An ESOP is a tax-qualified retirement plan (profit sharing and/or money-purchase plan) that is required to invest primarily in the stock of the company.

There are three key differences with an ESOP that differentiate it from a 401k plan:

- An ESOP is allowed to borrow money, which is ultimately used to buy shares of the company stock.

- An ESOP can engage in transactions with parties in interest, which in this case, is the purchase of the owner’s stock.

- The ESOP is required to invest in the stock of the employer, which most plans are prohibited from doing.

Creation of an ESOP

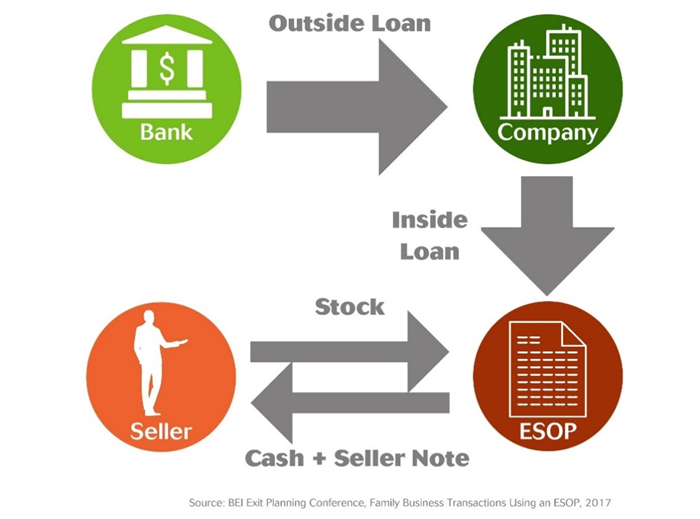

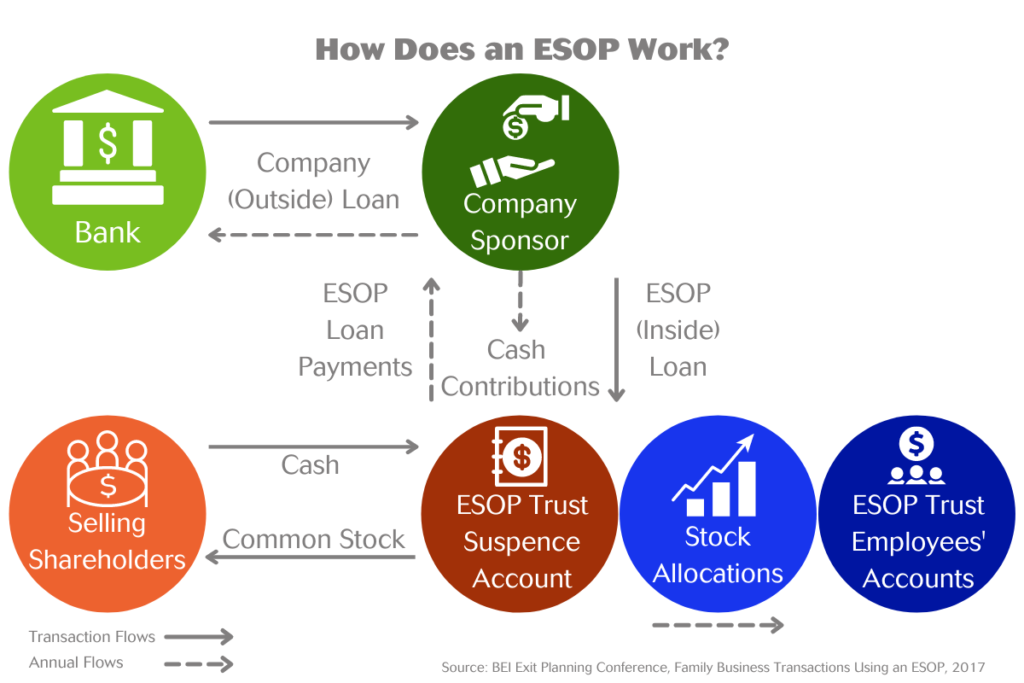

The plan is created by a company first requesting legal assistance to draft an ESOP plan and Trust. The company then goes to a bank and borrows money that is required to finance the transaction. The company then re-lends that money to the ESOP. Next, the ESOP takes that money and combines it with a seller note (a note from the owner), and uses those two sources of capital to purchase stock from the founding shareholder(s).

Once the ESOP is established, every year the company will make a contribution or a contribution plus a dividend (or a distribution in the case of an S-Corp), to the ESOP and the ESOP immediately uses those funds to pay off the loan from the company. The company takes those proceeds and uses them to pay off the outside loan from the bank and the seller’s note.

Usually, the company uses the funds to pay off the bank loan first. But, while it’s paying off the bank loan, it is paying the interest on the seller’s note. So, once the Bank loan is paid off, the company will pay off the principal and interest on the seller’s note.

As this is occurring over time, shares are gradually released from the ESOP suspense account and are allocated to the accounts of the employees.

With an ESOP, the company contributes new shares of its own stock or cash to buy existing shares. A Leveraged ESOP is when the ESOP can borrow money to buy new or existing shares, with the company making cash contributions to enable the plan to repay the loan. An ESOP is the only retirement plan that is allowed to borrow money. The contributions to the plan by the company are tax-deductible, regardless of how the plan acquires the stock.1

An ESOP is managed or governed by a Trustee, who is appointed by the board of directors. The voting rights of the employees are only required to be at a minimum.

Employee Participation

When the plan is in place, the company’s contributions to the ESOP are tax-deductible to the company and tax-free to its participants. Each qualified employee (participant) of the company has an account in the plan or trust. Assets build up over time, in each account based on contributions from the employer and/or employee. 2

Similar to a 401k plan, employees of the company become eligible for the plan by working at least 1,000 hours or more per year. They receive allocations that are determined by a formula based on relative pay or a formula that is more level. Similar to a 401k, employees are vested over time and can obtain these assets after a period of time after leaving the company.

Why Should Owners Create an ESOP?

Why would an Owner go through the complexities of forming an ESOP rather than selling the company in a third-party transaction? A few reasons:

The Owner wishes to take good care of the employees. An ESOP, assuming the company remains significantly profitable and growing, can create real, significant wealth for the employees, and gives the employees a great sense of ownership. Managers have added stake in the success of the company and a strong culture and group cohesiveness develops.

More importantly, an Owner selling to an ESOP creates significant tax advantages for both themself and the company. The company tax advantages differ depending on whether it is a C-Corp or an S-Corp. For a C-Corporation, the company receives a tax deduction for the contributions made to the plan, provided IRS guidelines are followed. It gives the company a way to deduct not only the interest paid on the loan but also the principal. A C-Corporation can also get a deduction for dividend payments to the ESOP (additional rules apply).

The tax benefits for an S-Corp differ. It still includes the benefit of deducting principal and interest payments, but the big tax benefit is the extent of the ESOP ownership of the company’s stock, that percentage of company income will be forever-free from taxes. So, if you have a 100% ESOP-owned S-Corporation, that percentage of the company’s income will be forever tax-free. Essentially you have a “for-profit company” treated as a “not-for-profit company,” commonly known as the “ESOP tax shield.”

Additionally, the Owner and shareholders can sell their shares free of taxes, hence the tax-free sale of the Owner’s shares to the ESOP. For a C-Corp shareholder, they’re able to make an election under section 1042 of the IRS code, which allows them to reinvest their money and not pay tax on the sale proceeds that they received from the sale of the stock to the ESOP, investing in another stock (like a large publicly-traded company). Taxes are due when the Owner sells those shares.

For an S-Corp Owner, that selling shareholder is able to recapture their basis in the company tax-free. Before the Owner sells to the ESOP, there is a leveraged distribution of the Owner’s AAA cost basis, which the company distributes to the Owner before the ESOP transaction. Then, the Owner will sell to the ESOP for the FMV of the stock less the basis distribution, paying only capital gains tax on the value (less the cost basis). For example, if an Owner’s stock is worth $20 million and the cost basis is $9 million when the Owner sells to the ESOP, they pay capital gains tax only on $11 million of the total value of the sale.

Recap of Tax Benefits

C-Corporations

Contributions to the ESOP are tax-deductible (principal and interest).

ESOP sales proceeds are tax-free for shareholders (IRC sec. 1042).

The company deducts dividends paid to ESOP.

S-Corporations

Contributions to the ESOP are tax-deductible (principal and interest)

S-Corporations do not pay tax at the corporate level – shareholders pay tax.

ESOP is exempt from income tax.

To the extent of the ESOP’s ownership, corporate earnings are tax-free.

When an ESOP is incorporated with additional estate planning, the tax efficiency becomes quite powerful (to be covered in a future article).

Are you a Good Candidate for an ESOP?

ESOPs are appropriate in about 20% of situations. Here are some criteria to help conclude if an ESOP is appropriate for you:

- You are sensitive to taxation, especially the taxation of a sale.

- You are legacy or culture motivated.

- You have a minimum adjusted EBITDA of $1 million, but $2 million is more optimal. The fees run at least $300,000. Thus, the bigger and more profitable the company, the more justifiable the fees. When the value of the transaction is upwards of $20 million to $30 million, it becomes reasonable. ESOPs are not appropriate for micro-sized companies.

- Company cash flow needs to be strong and consistent.

- Your company has a solid base of workforce (minimum of 10 to 25 employees).

- Strong successor management.

- Low level of company debt.

- Your company is committed to its employees and its community.

Additional Criteria

- You’re interested in implementing a minority interest transaction because you insist on staying in control. A private equity firm will almost never be interested in a minority interest transaction. So, an ESOP might be a solution.

- There’s interest in a liquidity-event plus family succession. If you want liquidity from the business in order to treat your children fairly and perhaps complete charitable goals, at the same time you want to remain in control, a minority sale to an ESOP could make sense. Then later, sell the remaining shares.

- A company that is committed to independence.

- A company where there isn’t any market for selling it, though currently, that is probably not the case. But, perhaps today, a construction firm might be interested in a sale to an ESOP if the conditions are right. Source: Family Transitions using an ESOP; BEI Exit Planning Conference

There are many potential advantages to selling your company to an ESOP. There are also potential disadvantages. It is important to work closely with a qualified business exit planner and consultant to objectively weigh all the options when exiting a business. If an ESOP makes good financial sense, an exit planner can refer you to an ESOP expert to prepare a feasibility analysis.

Remember, exiting a business is probably the single most important decision a Business Owner will make during the time of ownership and you only get one chance to do it right.

If you would like more information on a well-rounded exit planning process or have any further questions on the subject, feel free to contact me at [email protected].

Footnotes

- Selling Your Business to an ESOP, Ninth Addition, National Center for Employee Ownership, page 4

- Selling Your Business to an ESOP, Ninth Addition, National Center for Employee Ownership, page 4

Steve Zeller

Steven E. Zeller

Steven Zeller is a CERTIFIED FINANCIAL PLANNER™ professional, Accredited Investment Fiduciary®, Certified Exit Planner, practicing Wealth Advisor, and serves clients nationwide. He has over 24 years of experience within his profession. READ MORE

What Steve Writes About

I write about the latest thoughts and topics that impact high net worth families, individuals, and business owners. The building and sustainability of family wealth and a business is an exciting journey, and I have a passion to help them along the way to grow and thrive.

The latest book that Steve is reading. He reads, all he can, material relevant to the high net worth family and business owners, so that he may pass it onto his readers.

Connect With Steve